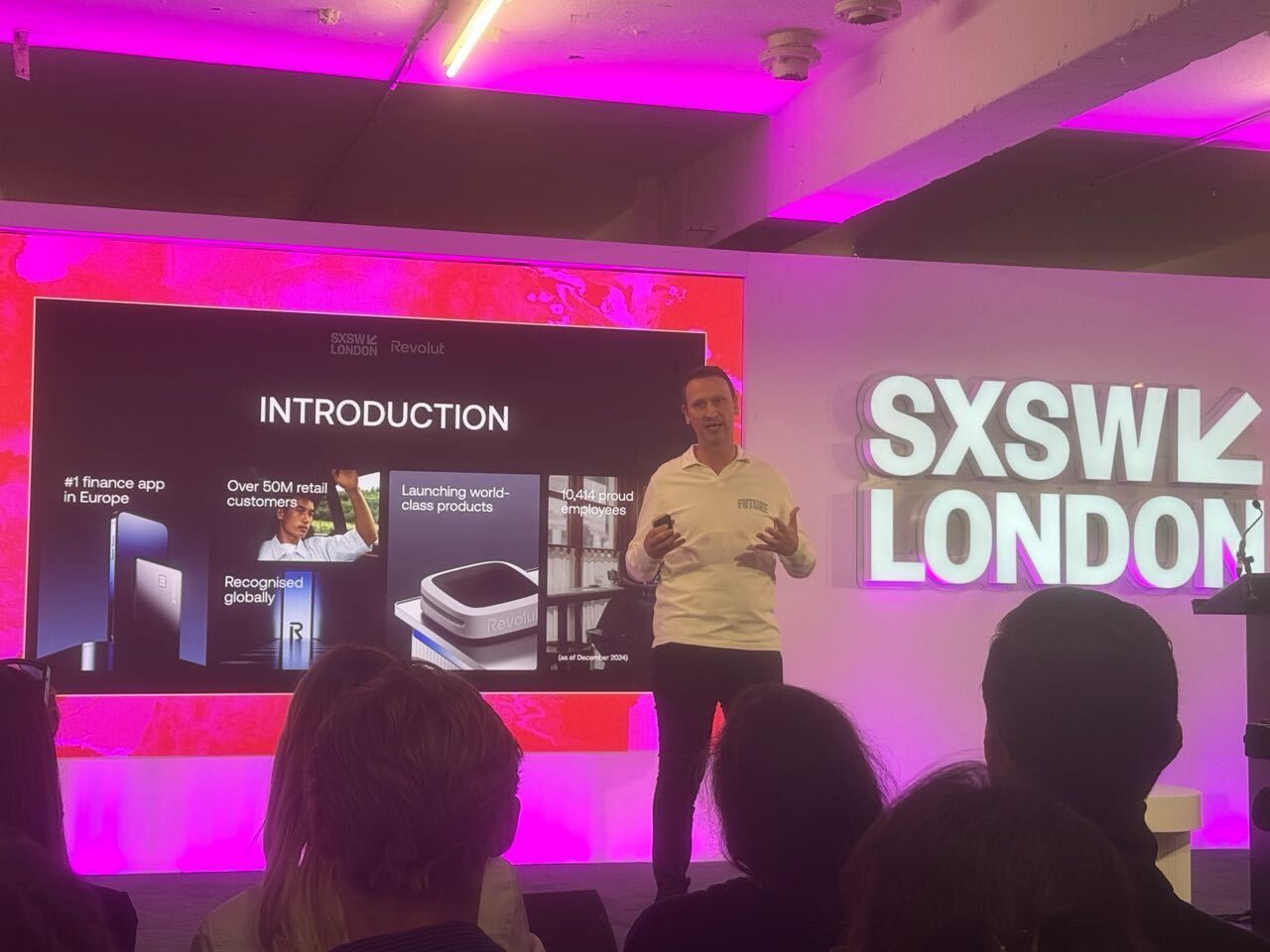

When Antoine Le Nel stepped on stage at SXSW London, it wasn’t to deliver a glossy keynote. It was to decode one of fintech’s most elusive success stories: how Revolut quietly became a $4 billion revenue engine across 40 markets without ever asking users to “switch banks.”

What followed was less of a marketing talk and more of a masterclass in product-led category creation.

From FX Tool to Fintech Superpower

Revolut didn’t start by “building a better bank.” It began by solving a specific traveler pain point: how to spend and exchange money efficiently abroad. But its ambitions were global from day one. Instead of trying to dominate the UK and expand later, Revolut launched with a multi-market, multi-product mindset.

Today, it’s the #1 financial app in countries as diverse as the UK, France, Spain, Poland, and Vietnam. And it’s still adding use cases from ATMs in Barcelona to lifestyle perks, crypto, and mobile plans.

The category? It’s not banking. Not exactly. “Are we a bank or not? The answer is: it doesn’t matter. What matters is how people use us.”

No to Bank Switching. Yes to Snackable Adoption.

Traditional banks want customers to switch everything. Revolut, by contrast, believes in “migration through momentum.” You might first download the app for holiday FX. Then try crypto. Then start using your Revolut card every day. Then credit. And eventually, without even realizing, you’ve made Revolut your primary financial hub.

This snack-sized adoption isn’t just customer-friendly. It’s cost-efficient. Every product offers a new entry point, with the customer journey growing organically over time.

Why Revolut Doesn’t Obsess Over Competitors

One of Revolut’s most provocative principles? Internal competition.

Instead of spending time tracking Monzo or traditional banks, Revolut’s teams benchmark against each other. If France is outperforming the UK, resources shift. If influencer activations work in Spain, they get replicated in Germany. Every market is a proving ground, and every win becomes a playbook for the rest. “It’s better to copy yourself than second-guess someone else.”

When Product Is the Brand

Antoine doesn’t come from a banking background. He cut his teeth scaling Candy Crush. And the lessons carried over.

At Revolut, the product is the brand. Users talk. Experience spreads. For years, the company scaled to 50M users with little paid marketing. That wasn’t a fluke it was a signal. Growth is earned through utility, not noise. “If no one knows about your product, maybe it’s not that great. Go back and fix it.”

Lifestyle, Loyalty & the Super App Dilemma

Revolut is now moving beyond finance. Lifestyle rewards. Telco plans. Travel perks. In-app investing. Even a proprietary ATM network for global users.

But it’s not aiming for a singular “super app.” Instead, Revolut’s strategy is modular and agile. It’s less about grand narratives and more about constant iteration responding to what users want now, not what they might want a decade from now.

What’s Next? Scaling Licensing, Expanding Global Banking

The goal is simple but audacious: become the one-stop global platform for money. That means scaling not just the product or the customer base but the entire regulatory framework that supports it.

Expansion is already underway across Latin America, India, Southeast Asia, and the Middle East. But as Antoine emphasized, growth won’t come from aggressive acquisition. It will come from relevance, consistency, and relentless execution.

Make sure you don’t miss us.

To keep these insights in your main inbox, follow these quick steps:

Gmail:

Mobile: Tap the 3 dots top right → ‘Move to’ → ‘Primary’

Desktop: Drag this email to your ‘Primary’ tab

Apple Mail:

Tap our email at the top → ‘Add to VIPs’Other apps:

Add [email protected] to your address book

PROUDLY SPONSORED BY

Powering smarter budget decisions with full-funnel marketing measurement and

forecasting for the post-iOS 14 era.

Independently Created. Not affiliated with SXSW.

Unofficially SXSW is a ClickZ Media publication in the Events division